The EPFO Passbook is a vital tool for employees to monitor and manage their provident fund contributions. It provides a clear overview of monthly deposits, employer contributions, and accrued interest, making it easy to track your financial growth over time. Accessing and understanding your passbook ensures transparency and helps in planning for long-term savings and retirement.

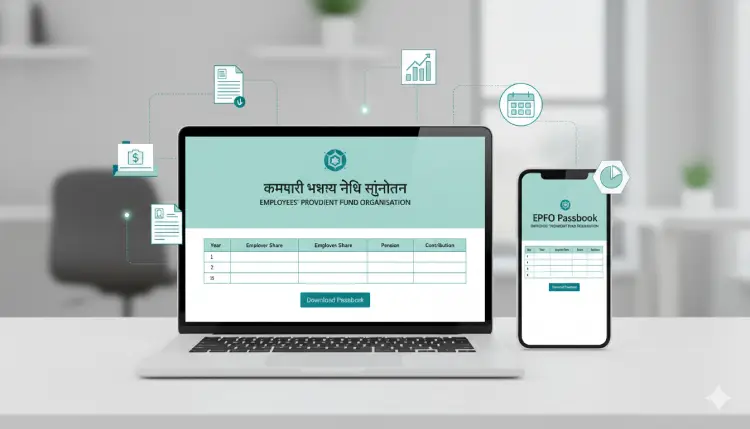

With the rise of digital services, checking your EPF account has become convenient through the EPFO Portal. Employees can now view their passbook online anytime using their Universal Account Number (UAN) and login credentials. This eliminates the need for physical statements and simplifies fund management for every registered employee.

How to Access Your EPFO Passbook

To view your EPFO passbook, follow these simple steps:

- Visit the EPFO Portal and navigate to the passbook section.

- Click on Employee Login or EPFO UAN Login.

- Enter your UAN, password, and captcha code.

- Once logged in, select the relevant member ID if multiple accounts are linked.

- Your EPFO passbook will display the latest contributions and balance.

This process is straightforward and can be completed in minutes. Using your EPFO account online ensures your provident fund data is up-to-date and easily accessible.

Checking PF Balance Using EPFO Login

Apart from viewing the passbook, the portal allows you to check PF balance directly. Employees can log in through EPFO Employee Login or PF Login options to see detailed records of contributions and employer deposits. The balance is updated monthly and includes accrued interest, offering an accurate picture of your provident fund growth.

Understanding Entries in the EPFO Passbook

Each entry in the EPFO Passbook contains important details:

- Employee Contribution: Monthly deposits made from your salary.

- Employer Contribution: Amount deposited by your employer.

- Interest Earned: Calculated on total contributions at the prevailing rate.

- Total Balance: Sum of contributions and interest, updated every month.

Reviewing these entries regularly helps ensure that both your and your employer’s contributions are accurate and consistent.

EPFO Employer Login: A Quick Overview

Employers also have a dedicated login portal called EPFO Employer Login. This platform allows organizations to:

- Submit monthly employee contributions.

- Update employee records and KYC details.

- Download reports and generate passbooks for employees.

Using the employer login ensures compliance with EPF regulations and smooth management of employee accounts.

Benefits of Using the EPFO Unified Portal

The EPFO Unified Portal simplifies fund management for both employees and employers. Key advantages include

- Easy online access to EPF statements.

- Secure login using UAN credentials.

- Ability to download PDF versions of your EPFO passbook.

- Quick updates and minimal dependency on offline submissions.

The unified system improves transparency and makes fund tracking more convenient for all registered members.

Steps to Download Your EPFO Passbook

After logging in, employees can download their passbook for offline reference:

- Navigate to the passbook section under EPFO Employee Login.

- Select the member ID and relevant time period.

- Click the download button to save the passbook as a PDF.

- Print it if a physical copy is required for record-keeping.

Regularly downloading your passbook ensures you have a personal copy for audits, loan applications, or retirement planning.

Tracking Contributions and Managing Accounts

By regularly checking your EPFO passbook, you can:

- Monitor both employee and employer contributions.

- Verify that monthly deposits are accurately reflected.

- Track interest accumulation and account balance.

- Ensure your UAN-linked account is active and updated.

Proactive management of your EPF account through the portal provides peace of mind and financial clarity.

Stay Updated with Your Provident Fund

Using the EPFO Portal along with your UAN login and EPFO credentials allows employees to stay informed about their provident fund status. Keeping track of contributions and passbook updates ensures transparency and prepares you for a secure financial future.

FAQ (Frequently Asked Question)

Q1: What is an EPFO passbook?

The EPFO Passbook is an online statement showing your employee provident fund (EPF) contributions, employer deposits, accrued interest, and total balance. It helps track and manage your PF account conveniently.

Q2: How can I view my EPFO passbook online?

You can view your passbook by logging into the EPFO Portal using your UAN credentials. After logging in, select your member ID to access your latest EPF transactions.

Q3: Can I download my EPFO passbook?

Yes. After logging in, navigate to the passbook section, choose the relevant time period, and download it as a PDF for personal records or offline reference.